News List

New tax rules are creating confusion

Home-related tax rules changing over the past few years have caught some taxpayers by surprise.

Do You Need to File a Tax Return?

Getting this wrong can cost you

One of the more common tax questions is whether you need to file a federal tax return this year. The answer is: it depends. But not filing a tax return when you should can cost you plenty. Here are some quick tips to help you determine your answer.

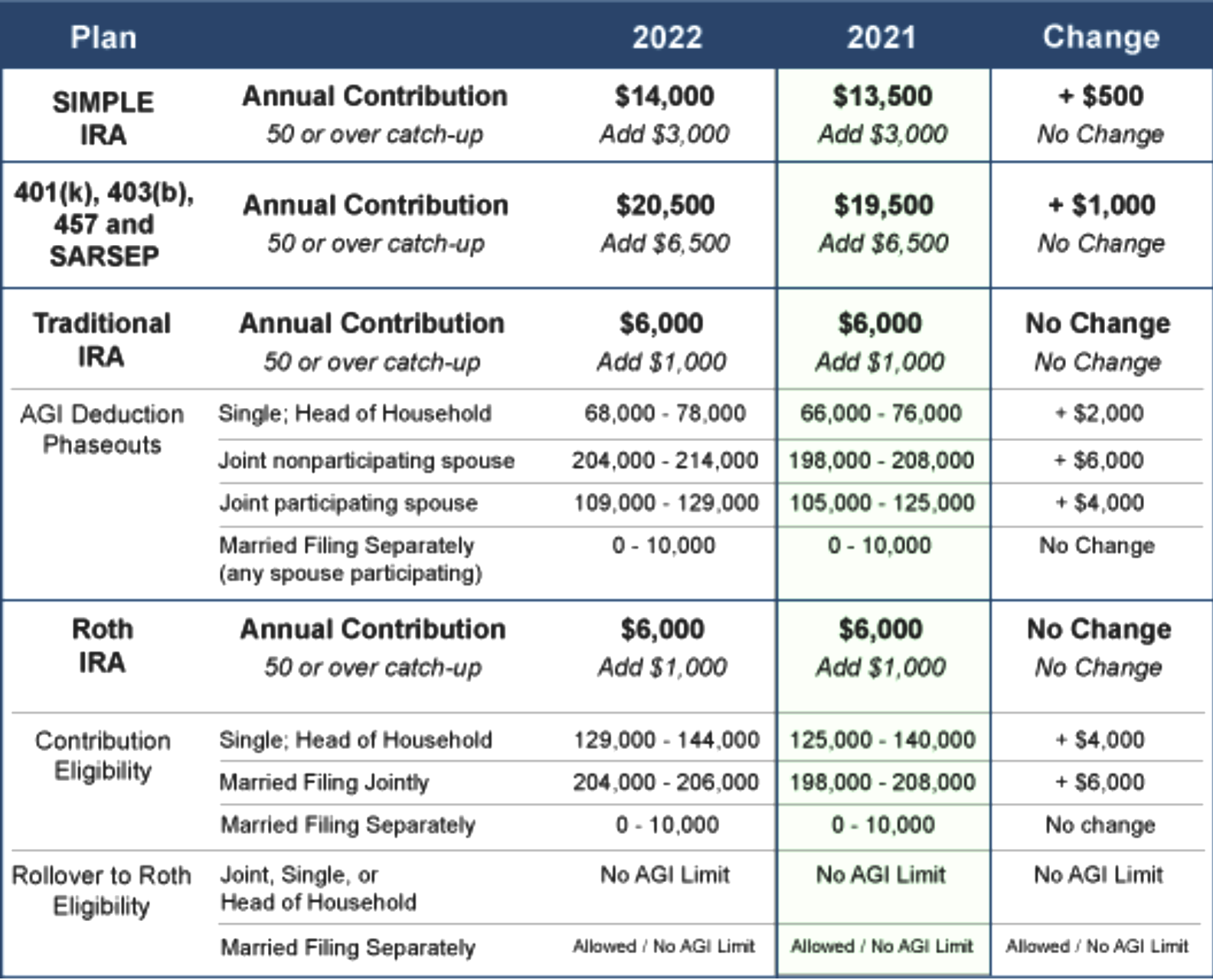

Plan Your Retirement Savings Goals for 2022

There’s good news for your retirement accounts in 2022! The IRS recently announced that you can contribute more pre-tax money to several retirement plans in 2022.

Medical group revenues falling faster than expenses

According to the 2021 Medical Group Operations and Finance Survey, Medical groups are still feeling the COVID-19 pandemic as revenues are falling faster than expenses.

Ideas to Improve Your Financial Health in 2022

A new year. New resolutions. Here are five ideas to consider to help improve your financial health in the upcoming year.

Debt: Gone But Not Forgotten by the IRS

With the ups and downs of our economy over the last 2 years, you may have had a loan or credit card balance forgiven or cancelled by a financial institution.

Knocking Down Scholarship Barriers

Supporting the future of Accounting has always been one of my aspirations and being part of a campaign to help the scholars is a way to fulfill that. Let us both support the FICPA Accounting Scholars to achieve their dreams.

The Benefits of Being a Sole Proprietor

Many start-up businesses move from hobby status to a business when they start to make a profit. The tax entity typically used is a sole proprietorship. Taxes on this business activity type flow through your personal tax return on a Schedule C.

Your guide to post tax-fling record retention

Before you close this year’s tax file there is still some work to do. If the IRS or state revenue department selects your return for review, you will need to be prepared. Here is what you need to do now:

Small Business: Coping with Shortages and Delays

As we enter the New Year, businesses continue to be hampered by a near-unprecedented lack of supplies and materials.

How to reduce surprise billing in your practice

Physicians need to become aware and informed with their patient’s network status and understand the benefits from the plan they have, are all the provider seek care with enough.

Tips to Maximize the Value of a Car Donation

While it is one of the biggest contributions a taxpayer can make, if not done carefully, the tax deduction of a donated vehicle could be a lot lower than you think.

What? This Form 1099 is Wrong! What to do to fix this thorny problem

In a recent announcement, the IRS is telling taxpayers it’s turning off some of its automated notices. Here is what you need to know.

Marie M. Rosier – Awardee for The 40 Under 40 Black CPA Award

On the 100th anniversary of Black CPA Centennial, our very own Marie M. Rosier was chosen to be one of the awardees of the 40 Under 40 Black CPA Award.

Why physicians need a good financial adviser

In the form of various experts physicians know and deal with, a skilled financial advisor contributes much more to the business.

The Secret to a Quick Tax Refund

Delayed tax refunds, penalties for not filing 2020 tax returns on time that were actually filed on time, and timely tax payments being flagged as late are just some of the headaches taxpayers are grappling.

Review Financial Decisions When Interest Rates Change

The Federal Reserve’s actions probably will exert at least a moderate influence over financial choices that you may make at home and in your business in 2022 and beyond.

Business Metrics that Have Impact

At the end of the year it is easy to compare revenue, gross margin, and profitability to the prior year and to your business plan. Here are a few ideas of other metrics to consider.

Common Tax Increase Surprises (I did not owe that last year!)

Picture this: For the past few years you’ve received your tax return and have had a small but nice refund. Now imagine your surprise, when this year, you are required to send in a fairly big check to settle your tax bill. Believe it or not, this message is almost as hard to deliver to you as it is to hear it.

Tax Saving Tips for Parents AND Grandparents

With careful tax planning, you can use the kiddie tax rules to reduce your tax obligation. Here’s what you need to know.

SBA details process to appeal partial PPP loan forgiveness decisions

Only received partial forgiveness of your PPP Loan? The SBA outlines process to request review of partial approval forgiveness decisions issued by PPP Lenders

Plan Your 2022 Retirement Contributions

With the cost of living calculations and increases in inflation, higher phaseout limits make many more taxpayers eligible for fully deductible contributions. So plan now to take full advantage of this tax benefit.

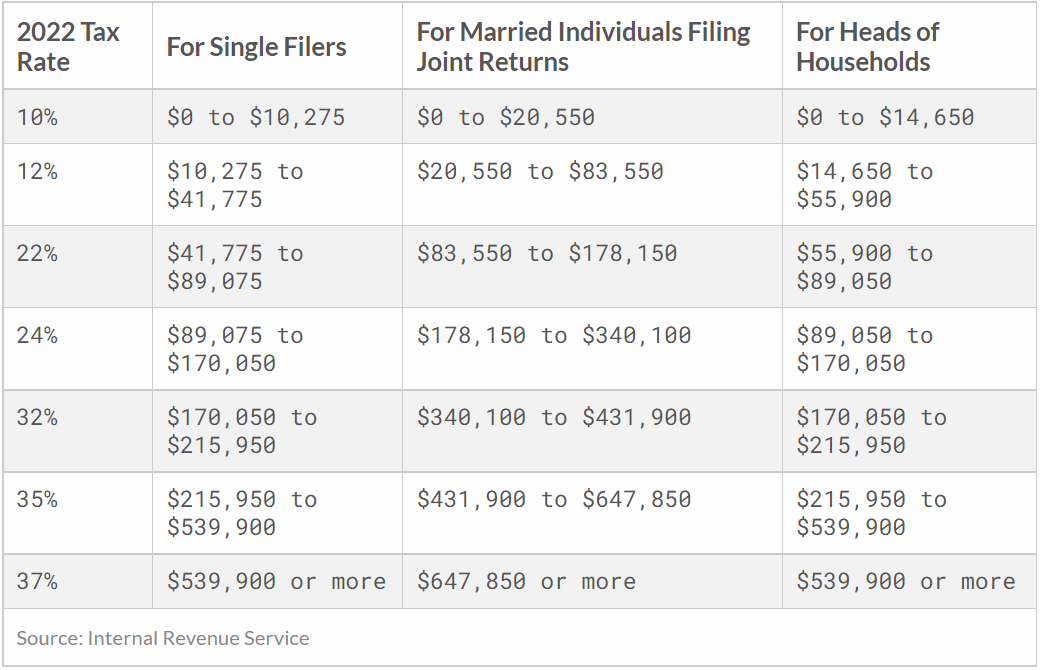

2022 Tax Brackets

In the coming year 2022, the income limits for all tax brackets and all filers will be adjusted for inflation. See table as follows:

10 deductions physicians should check out

There are tax planning strategies physicians can still put into action to set themselves up for tax savings for this year, 2021. Here are 10 deductions physicians should learn about.

What? This Form 1099 is Wrong! What to do to fix this thorny problem

It is late February and you realize the Form 1099 you received is in error. In fact, it overstates your income by several thousand dollars. What should you do?

Why you and your practice need an exit plan.

Having an exit plan as a healthcare entrepreneur shouldn’t just be an option, but a necessity. The rule: If you receive rental income for less than 15 days per year, that income is generally not taxable income.

Rent Your Property Tax-Free

Most income you receive is taxable income that is reported to the federal and state tax authorities. However, renting out your home or vacation property on a short-term basis can be done tax-free if you follow the rules.

Specific tax fraud traps physicians should avoid

The IRS warns people to lookout for the tax scams peddled by tax promoters. These promoters will propose too good to be true “deals” that will cheat the system and market aggressively…

Small Business Tax Return To-Do-List

Consider these suggestions for helping to make tax season smooth sailing this year for your small business: Make your estimated tax payments. Tuesday, January 18th is the due date to make…

Leveraging Kiddie Tax Rules

Now is the time to take action on reducing next year’s tax bill. One area to help reduce your tax obligation is leveraging your kids to the fullest by understanding the kiddie tax rules.

New Higher Estate And Gift Tax Limits For 2022

The new numbers essentially mean that wealthy taxpayers can transfer more to their heirs tax free during life—or at death. A lot more.

Surprise Bills: Prepare Your Business for the Unexpected

Getting a bill for an unexpected expense can put a significant dent in your business’s cash flow. Here are some tips your business can use to deal with a surprise bill….

Postpone Taxes with a Like-Kind Exchange

By following certain rules, you can postpone some or all of the tax that would otherwise be due when you sell property at a gain…

Five steps to start your own independent practice

Nowadays, physicians chooses to practice their profession on their own or independently. Some were given the opportunity to have their own practice to start their career…

A Dozen Tax Planning Triggers

With all the tax law changes over the past few years, here are some things that should trigger you to conduct a full tax planning session to ensure your tax bill is not higher than it needs to be….

Is it really the IRS?

Pretending to be an IRS agent is one of the favorite tactics of scam artists, according to the Better Business Bureau. The con artists impersonate the IRS to either intimidate people into making payments…

Employee Tax-Free Income

While most income received from your employer quickly ends up on a W-2 tax form at the end of the year, here are some common employee benefits that often avoid the impact of Federal taxes…

Higher 2022 Retirement Account Contribution Limits For 401(k)s, Not IRAs

The Florida Department of Revenue Tax Information Publication (TIP) 21A01-11 “Sales Tax Exemption on Items That Assist…

Tax Moves to Make Before Year-End

There are always moves you can make to reduce your taxable income. Some of these tax-saving moves, however, must be completed by December 31. Here are several to consider:

2022 Health Savings Account Limits

The savings limits for the ever-popular health savings accounts (HSA) are set for 2022. The new limits are outlined here with current year amounts noted…

Tips to avoid IRS penalties on 401(k) retirement plan distributions

While each retirement plan has similar early withdrawal penalty exemptions, they are not all alike…

15 Year-End Tax Tips

It’s that time again! The final chance to reduce your annual tax bill is here. Spend a few minutes considering the following ideas:

Infrastructure bill tax provisions include ERC termination

The infrastructure legislation ends the employee retention credit (ERC) early, making wages paid after Sept. 30, 2021, ineligible for the credit (with few exceptions)….

Year-End Tax Planning Ideas For Your Business

As 2021 winds down, here are some ideas to consider in order to help manage your small business and prepare for filing your upcoming tax return. Identify all vendors who require a 1099-MISC and a 1099-NEC….

Five Tax-Loss Harvesting Tips

Though the markets have been up strongly this year, your investment portfolio could have a few lemons in it. Using the tax strategy of tax-loss harvesting, you may be able to turn those lemons into lemonade. Here are five tips:

The Greatest Theft in America

And you are a victim!

Where did that money go? Who took it and why aren’t you upset about it? Your interest income actually benefits someone else…

The Power of Comparative Financial Statements

Your business has a story to tell. And one of the ways to hear your business’s story is by reading through comparative financial statements. An up-to-date balance sheet, income statement and statement of cash flows…

2021 Tax Highlights

Last year was the year of the pandemic, multiple economic stimulus payments, delayed tax due dates and tax law changes long after the year is finished. Here’s what you need to know in the year 2021. Potential Pandemic Relief Rollbacks…

Sales Tax Exemption on Items That Assist in Independent Living

The Florida Department of Revenue Tax Information Publication (TIP) 21A01-11 “Sales Tax Exemption on Items That Assist in Independent Living” dated October 18, 2021, has been posted to the Department’s website…

Marie M. Rosier – Awardee for The 40 Under 40 Black CPA Award

The Black CPA Centennial is a year-long celebration in recognition of the 100th anniversary of the first Black CPA in the United States led by a consortium of organizing partners, including the American Institute of Certified Public Accountants,

We are proud to sponsor the FICPA Scholarship Nights

As our company’s way of supporting the future of the accounting profession, we are proud and honored to contribute an be part of this year’s FICPA Scholarship Nights. Join us as we celebrate 22 FICPA scholars be the future CPA Leaders in FL. Happening on..

Summary of key business tax provisions contained in the year-end coronavirus relief act.

As the coronavirus (COVID-19) continues to affect local communities and global economies, our firm remains committed to serving your tax and financial planning..

How teleworking is impacting your tax obligations during the COVID-19 pandemic

As the COVID-19 outbreak continues, many employers are continuing to encourage or require their employees to work from home (i.e., telework). Such remote working arrangements could potentially have tax

Important changes to the child tax credit

Recently, there were changes made to the child tax credit that will benefit many taxpayers. As part of the American Rescue Plan Act that was enacted in March 2021, the child tax credit:

• Amount has increased for certain taxpayers